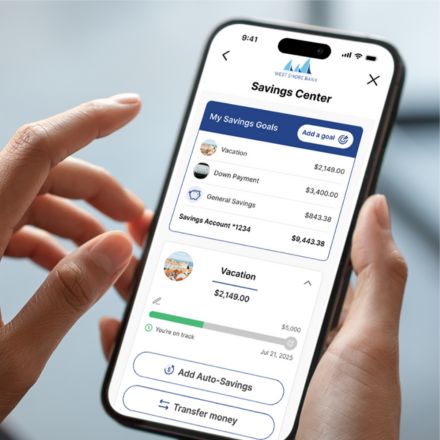

At West Shore Bank, we understand that building your savings can sometimes feel overwhelming. But it doesn’t have to be. That’s why we’re excited to introduce the new Savings Center within our digital banking platform—a personalized, automated savings experience designed to help you reach your financial goals faster and easier than ever before.

Whether you’re saving for a down payment on a home, a dream vacation, an emergency fund, or something more personal, the Savings Center puts you in control. With powerful features like round-up savings, recurring transfers, and goal-based tracking, you can finally put your savings on autopilot. And because it’s integrated directly into your West Shore Bank app and online banking, managing your money and your goals happens seamlessly all in one place.

Choose the Right Savings Account For You

West Shore Bank offers a variety of FDIC-insured savings accounts tailored to your needs:

- Statement Savings: Start with $100, earn competitive interest, and avoid fees with a $100 balance.

- Money Market Savings: Tiered interest rates - the higher your balance, the higher your interest rate and avoid fees with a $1000 minimum balance.

- Certificates of Deposit (CDs): Higher rates for fixed terms from 3 to 60 months, starting at $500.

- Steady Saver Account: Automate monthly savings toward a goal, with higher interest.

- Christmas Club Account: Save for the holidays with automatic transfers and interest—no fees or minimums.

- IRAs: Traditional, Roth, and Coverdell Education accounts with tax advantages.

- Health Savings Account (HSA): Save tax-free for medical expenses with flexible contributions.

Start Saving Smarter with West Shore Bank

No matter your goals, we’re here to help you save smarter and reach them faster. Visit us at any of our branch locations or contact us today to find the best savings option for you.

.jpg)