With West Shore Bank, saving for your dreams is finally simple.

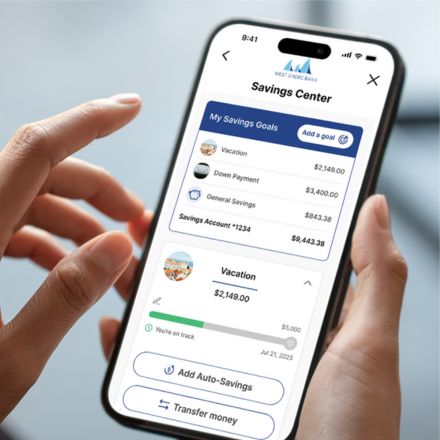

Saving Center

.jpg)

Watch your savings grow effortlessly

Our new Savings Center helps you reach your financial goals with ease.

Whether it’s a new car, your next big trip, or your child’s education,

we're here to help you reach your goals effortlessly.

Build the life you dreamed of...

Saving doesn't have to be hard. In fact, most Americans say they want to save more but aren't sure where to start. Whether you're starting small or aiming big, the Saving Center helps you take the first step with confidence. Set a goal, stay on track and reach your goals.

Save without thinking about saving...

With the Savings Center, you can track your financial goals, discover simple ways to fund them, and watch your savings grow effortlessly with Automated Savings. With tools like automated transfers* and round-up savings, you don't have to think twice about saving. Just set your goal, turn on auto-save, and watch your progress grow with each everyday purchase. You'll be surprised how far you can go when saving becomes part of your routine.

*Savings transfers must come from a West Shore Bank checking or savings account.

FAQs

This guide explains how to use the Savings Center feature to create goals, save automatically, and manage your funds. It is intended for both banking customers and employees who support them.

🩷 How do I create a savings goal?

Creating a goal allows you to set aside money for something specific, like a vacation, emergency fund, or big purchase.

To create a goal:

1. Log into your online or mobile banking app.

2. Navigate to the Savings Center.

3. Tap “Create a Goal” (this may also appear as a "+" button or "Add Goal").

4. Enter the following details:

○ Goal Name (e.g., “Honeymoon Fund”)

○ Target Amount (how much you want to save)

○ Target Date (optional – helps you track your progress on a timeline)

5. Choose an image or icon to personalize your goal (if available).

6. Tap “Save” or “Create”.

Your new goal will appear on your Savings Center dashboard and will display your current balance and progress toward your target.

🩷 How do I turn on round-ups to a goal?

Round-ups automatically save your spare change by rounding each purchase to the nearest dollar and transferring the difference to your selected savings goal.

To enable round-ups:

1. Open the Savings Center and tap on the goal you’d like to fund.

2. Tap “Enable Round-Ups” or toggle the Round-Ups option on.

3. Select the checking account you want round-ups to come from.

4. Confirm your selection.

Once activated, every debit card transaction you make from that account will round up, and the spare change will be deposited into your goal.

Example: If you spend $4.50 on coffee, $0.50 will be rounded up and added to your savings goal.

🩷 How do I turn on recurring transfers to a goal?

Recurring transfers let you schedule regular contributions from your checking account to your savings goal—helping you save consistently.

To set up a recurring transfer:

1. Open your savings goal in the Savings Center.

2. Select “Set Up Recurring Transfer.”

3. Enter:

○ Transfer Amount (e.g., $20)

○ Frequency (e.g., every Friday, monthly on the 1st)

○ Start Date

○ Funding Account (checking account that will send the funds)

4. Review and confirm your transfer schedule.

Funds will be automatically transferred into your goal based on the schedule you set.

*Savings transfers must come from a West Shore Bank checking or savings account.

🩷 Can I turn on round-ups or recurring transfers for more than one goal?

Yes! You can set up recurring transfers for multiple goals, all from the same funding account if you’d like.

For round-ups, you can enable them on more than one goal only if you have multiple funding accounts. Each funding account can support one round-up rule, so you’ll need a separate checking account for each round-up-enabled goal.

🩷 What is “General Savings”?

The General Savings section represents any funds that are in your savings account but are not assigned to a specific goal.

Here’s how it works:

- When you deposit money directly into your savings account without assigning it to a goal, it shows under General Savings.

- You can move money from General Savings into a goal, or move funds out of a goal back into General Savings at any time.

This gives you flexibility in how you manage your savings—whether you want to earmark money or just keep it available in a general pool.

🩷 How do I move money between General Savings and a goal?

You can easily reallocate funds within your savings account.

To move money into a goal:

1. Open the goal you’d like to add funds to.

2. Tap “Move Money” or “Transfer Funds.”

3. Select General Savings → [Your Goal].

4. Enter the amount and confirm.

2. Tap “Move Money” or “Transfer Funds.”

3. Select General Savings → [Your Goal].

4. Enter the amount and confirm.

To move money out of a goal:

1. Open the goal.

2. Select “Move Funds Out” or a similar option.

3. Choose the amount to transfer and confirm.

4. The funds will be returned to your General Savings.

1. Open the goal.

2. Select “Move Funds Out” or a similar option.

3. Choose the amount to transfer and confirm.

4. The funds will be returned to your General Savings.

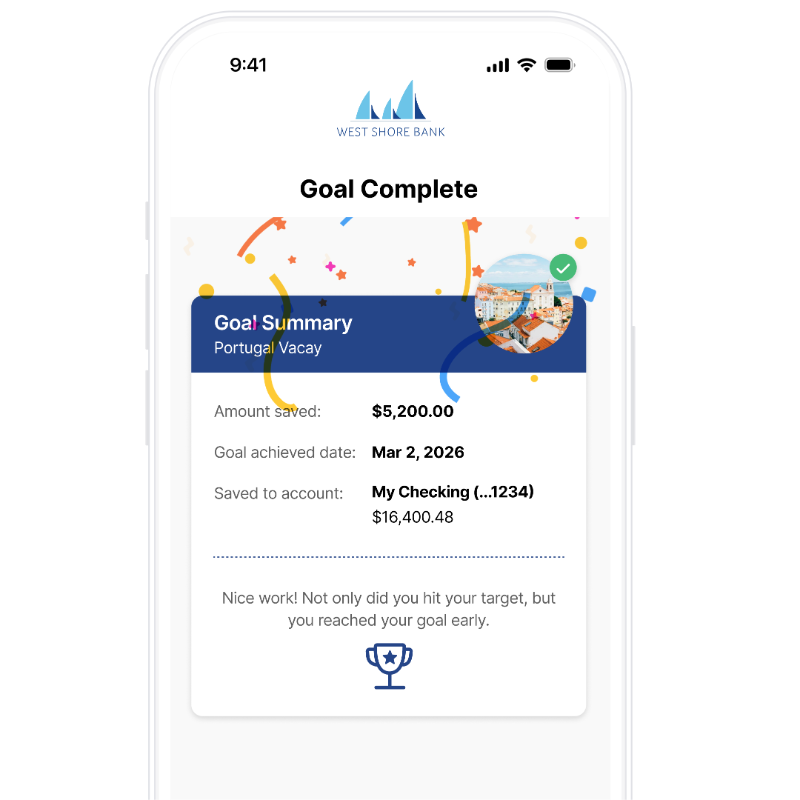

🩷 What happens when I reach my savings goal?

Once your goal balance reaches your target amount:

- The goal will be marked as “Completed” or “Goal Reached.”

- Funds will remain in the goal unless you choose to move them elsewhere.

At this point, you can:

- Leave the funds in the goal for safekeeping.

- Transfer the funds to your checking account or General Savings.

- Start a new goal with a different target.

🩷 Can I edit or delete a goal?

Yes. You have full control over your goals.

To edit a goal:

1. Open the goal.

2. Tap the edit icon (usually a pencil or settings gear).

3. You can update the name, target amount, target date, or goal image.

To delete a goal:

1. Tap into the goal settings.

2. Select “Delete Goal”.

3. The funds from the goal will be automatically moved back into General Savings.

1. Tap into the goal settings.

2. Select “Delete Goal”.

3. The funds from the goal will be automatically moved back into General Savings.

Deleting a goal is permanent, so be sure you’re ready to close it before confirming.

🩷 Can I split my roundup to a goal and to a nonprofit?

Yes, you can split your roundup and have a portion go to your goal and a portion go to a nonprofit of your choice.