As a new year dawns, we all find ourselves one year older as well. If you haven’t started saving for retirement yet, it’s never too early or too late to set goals and create a plan for reaching them. About 1 in 5 people age 59+ don’t have a retirement account, according to a recent survey. Unfortunately, Social Security benefits won’t be enough for most people to cover living and healthcare expenses in retirement without working. Keep reading to learn how you can calculate your desired retirement income and what your options are for starting a retirement savings account.

How Much Do You Need To Save For Retirement?

The answer to this question will be different for every person or couple. For example, it depends on your current cost of living and the type of lifestyle you hope to enjoy in retirement.

It’s a common misconception to think your expenses will be drastically lower in retirement. Yes, you may not be commuting to work or buying professional clothes anymore. Your kids may be grown and living independently. But you will still have housing, food, transportation, healthcare, and other expenses. Plus the discretionary things you’d like to spend on such as travel, hobbies, entertainment, etc.

So, a good place to start is to look at your current monthly expenses for the following categories (as applicable):

Housing

- Utilities

- Mortgage or Rent payment

- Property taxes

- Insurance premiums

- Maintenance costs

- Phone/Internet/Cable

Food

- Groceries

Transportation

- Fuel

- Vehicle maintenance

- Insurance

- Public transportation

- Car loan or lease payment

Healthcare

- Health insurance premiums

- Out of pocket costs

Personal Care

- Clothing

- Products and services

Insurance

- Life insurance

- Disability Insurance

- Long-term care

Additional Liabilities

- 2nd Home Mortgage

- Credit Card debt

- Home Equity Loan or Line of Credit

Add your monthly core expenses and then multiply by 12 to get an annual number. Next, let’s look at monthly discretionary spending:

- Dining Out

- Travel

- Entertainment

- Club Dues

- Hobbies

- Gifts

- Charity

- Education

- Other

Calculate your monthly and annual discretionary expenses and add to the core amount. This will give you a sense of the monthly and annual income you’ll need in retirement to maintain your current lifestyle and level of spending.

Other Guidelines For Retirement Savings

- According to a recent analysis, $66,563 is the average annual retirement income needed to live comfortably in Michigan.

- If you want to know where you should be with retirement savings based on your age, aim for 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

- Multiply your estimated annual retirement income by 25 for a total retirement savings goal. The 25x rule accounts for an annual portfolio withdrawal rate of 4%.

Use our Retirement Plan Calculator to test different scenarios, such as retirement age and desired income.

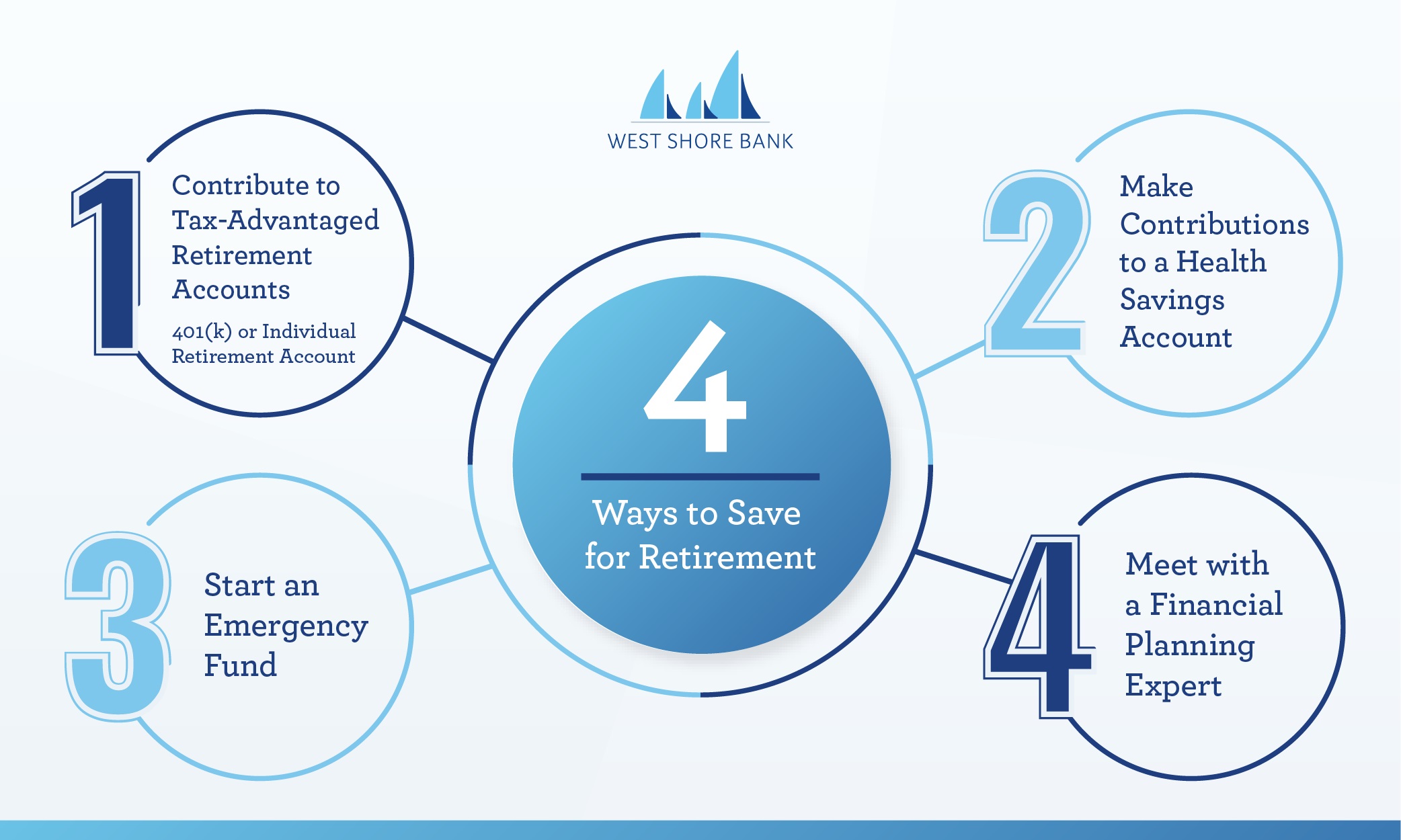

How to Save For Retirement

Understand your options for building the nest egg you need.

Tax-Advantaged Retirement Accounts

If your employer offers a 401(k) or 403(b), you should contribute at least enough to get the full employer match. Contributions are taken from your pre-tax income, so you won’t even miss it in your paycheck. And there are certain tax advantages with a 401(k) plan–talk to your tax advisor to learn more.

If you aren’t eligible for a 401(k) through work, you can open an Individual Retirement Account (IRA). These accounts also offer certain tax advantages. Choose between a Roth or Traditional IRA, in a risk-free savings account or in investments. A Wealth Manager can help you choose investments based upon your age and risk tolerance and help you build a portfolio that’s right for you.

401(k)s can also be rolled into an IRA after you leave your job.

Contribute to a Health Savings Account

If you’re enrolled in a high-deductible health insurance plan, you’re eligible to contribute to a Health Savings Account. These special savings accounts offer triple tax benefits: contributions, withdrawals, and dividends are all untaxed as long as you follow the rules. You can use your HSA to pay for current medical expenses, save for future healthcare costs, and as a retirement savings account.

Start An Emergency Fund

Cash savings is an important part of any retirement plan. Emergencies can happen at any age and stage of life, so start building your emergency fund now. Choose between a high interest savings account, Certificate of Deposit, or Money Market.

Meet With a Financial Planning Expert

Our Wealth Managers can help you plan for retirement and develop an investment strategy that will help you reach your goals. We can also help with trusts and estate planning. Contact us to learn more and schedule a free consultation.

Start Saving For Retirement Today!

West Shore Bank has been helping families achieve their financial goals since 1898. Open a new savings or retirement account today to start saving for retirement! You can also contact us with questions, visit any of our locations along the lake shore, or meet with one of our wealth management experts.